- #Budget planning app how to#

- #Budget planning app free#

Save money on international transfers with WiseĮach budgeting app is different. Send and save money with Wise! 📝 Table of contents And as a bonus if you need to manage money in different currencies, we cover the Wise app, which has some great features for just that. Read on to take a look at some leading budgeting apps and who they are best for. The best one for you will be the one that suits your needs. Each app has different features and approaches to money management. #Budget planning app free#

There are many budgeting apps on the market – some free and some paid. Budgeting apps help automate this process and present easy-to-follow analysis of your spending habits. Tracking your spending and expenses manually can be difficult.

Travelling to Australia Austria Bangladesh Belgium Brazil Bulgaria Canada Chile China Colombia Croatia Cyprus Czech Republic Denmark Egypt Estonia Finland France Georgia Germany Greece Hong Kong Hungary India Indonesia Ireland Israel Italy Japan Kenya Latvia Liechtenstein Lithuania Luxembourg Malaysia Malta Mexico Monaco Morocco Nepal Netherlands New Zealand Nigeria Norway Pakistan Peru Philippines Poland Portugal Romania Russia San Marino Singapore Slovakia Slovenia South Africa South Korea Spain Sri Lanka Sweden Switzerland Thailand Turkey Ukraine Vietnam The UAE The UK The USīudgeting apps are great when you need help managing and controlling your finances. Life in Australia Austria Belgium Brazil Canada China Croatia Cyprus Czech Republic Denmark Finland France Germany Greece Hong Kong India Indonesia Ireland Israel Italy Japan Luxembourg Malaysia Malta Mexico Netherlands New Zealand Nigeria Norway Pakistan Peru Philippines Poland Portugal Russia Singapore South Africa South Korea Spain Sweden Switzerland Thailand Vietnam The UAE The UK The US. Some of their goals include helping you know exactly how much you have on hand, keep tabs on your spending and see all your accounts at once. Pocket Guard provides an easy way to control your finances, improve your spending, and to automate your savings. Flexibility – it’s based on your most current information which makes it easy to update, change, or adjust your budget. #Budget planning app how to#

Gives your dollars jobs (strategically plan how to spend money to avoid impulse purchases). YNAB is a proactive system that seeks to educate you on money management, rather than ‘tricking’ you into saving money. You Need a Budget aims to help you gain total control of your money so that you can break the cycle of living paycheck to paycheck. Multiple currencies (ideal for international and exchange students or travellers). Customizable categories (you can also add a picture or location to every expense). Shared wallets (for family, spouses or roommates who handle money together). Spendee is a money manager and budget planner you can use to your advantage, regardless of your financial goals. Budget categorization (includes the ability to personalize). Bill tracking: online monthly tracking & reminders. Other than that, they allow you to customize each transaction (i.e.: if you pay rent using e-transfer, you can edit the transaction label as “Rent” instead of the automated general e-transfer label). Firstly, they merge your accounts so that it is easily accessible for your reference – they call this all-in-one finances.

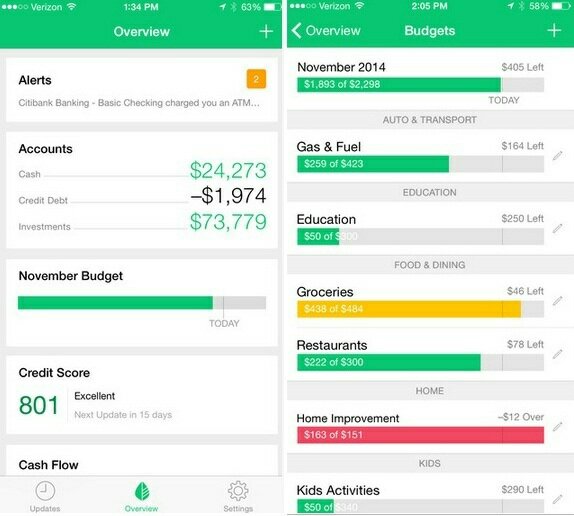

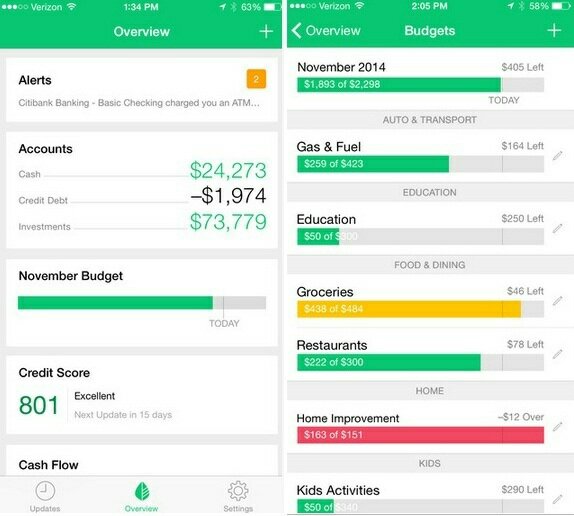

Mint is a great budgeting tool to step up your personal finance game. I decided to do the leg work for you, so here are five great options you might choose from. Now, this all sounds great but you may be wondering which app is best suited for you. Ability or option to sync with existing bank account(s).In general, there are a few characteristics to look out for if you want to maximize a budgeting tool on your phone. Budget Planning Apps: Features To Look Forĭepending on your financial situation and goals, you may find different features relevant to your needs.

If you are looking for a simpler, more centralized way to manage your student budget, a budget tracker app that you can access at your fingertips (literally) may be exactly what you need. We can all agree that ensuring our financial success in the future is a great goal, but let’s talk about how you can make the best of your financial situation right now. As a new graduate, you may find yourself balancing between paying off your debt and increasing your savings. Are you tired of downloading budgeting templates from personal finance YouTube channels and blogs that you don’t use? Do you struggle to maintain or keep up with your budget as a student? As a student, it may be overwhelming to manage your money independently for the first time.

0 kommentar(er)

0 kommentar(er)